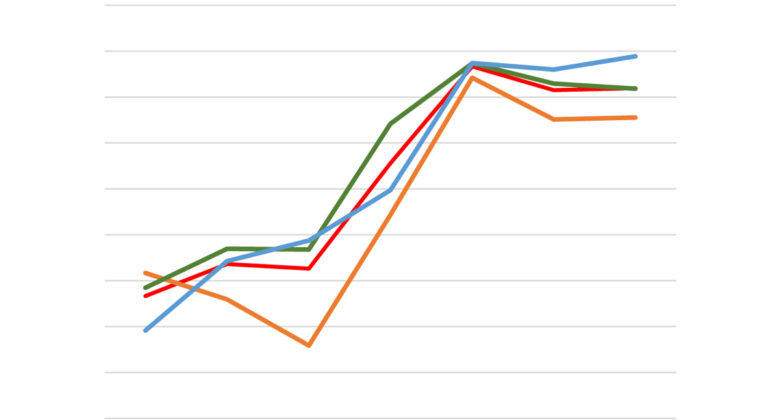

According to the National Association of Manufacturers’ (NAM) quarterly Manufacturers’ Outlook Survey, the first three quarters of 2017 have shown the highest three-quarter average (90.87%) of manufacturing firms’ optimism regarding their own company’s outlook since the survey began 20 years ago. Manufacturers of all sizes expect growth across a variety of indicators, including production, capital investments, employment, wages, sales, and exports. Furthermore, high levels of confidence in business conditions seen at the start of 2017 have held relatively steady through the rest of the year, particularly for large firms. Confidence in business conditions for small and medium sized firms dropped somewhat in the 2nd and 3rd quarters compared to the 1st quarter, but are still at significantly higher levels than in 2016.

While manufacturers are feeling positive about their own companies’ outlooks and overall business conditions, they also report some anxiety around political and geopolitical uncertainties. They cite concerns over potential state and federal policy actions, as well as the potential for conflicts around the world. Despite these concerns, improvements in the global economy have led to increased export expectations, which tend to be positively correlated with overall outlook. Manufacturers also once again noted rising health insurance costs as the top challenge facing their businesses. Coming in just a smidge behind health insurance costs, the second largest business challenge reported was attracting and retaining a quality workforce. This challenge of recruiting, training, and retaining workers is at top of mind for many of our local manufacturers. We’ve also heard this challenge from companies and organizations in various industries, so our Workforce Development Taskforce has launched an assessment survey to help us better understand the nature of these challenges and start to explore local solutions.

There is a lot more information packed into this survey. To read more about the most recent Manufacturers’ Outlook Survey, you can find the full report here: http://www.nam.org/Data-and-Reports/Manufacturers-Outlook-Survey/2017-Third-Quarter-Manufacturers-Outlook-Survey/.