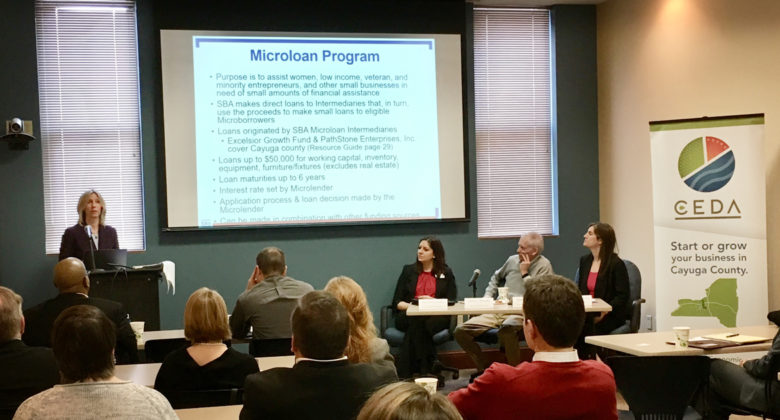

On Tuesday, February 26th, we held our first-ever “CEDA 101” session in our conference room at 2 State Street. Lenders from local financial institutions and other partner agencies were invited to get a refresher course about services and lending programs available from CEDA’s partners in the economic development community.

Maureen Riester, Economic Development Specialist at CEDA, gave an overview of the two local revolving loan funds that can be utilized as gap financing for a project or when traditional financing is not an option. She also illustrated how the IDA’s tax incentives can benefit a business and the community. Valerie Shoudy, Lender Relations Specialist, with the US Small Business Administration (SBA), presented on their Microloan, 504 Loan, and 7a Loan Guaranty program. We also heard from Tom Hauryski, Rural Development Specialist for the USDA, about their Business and Industry (B&I) Loan Guarantees, which can be provided in rural areas with a population of less than 50,000.

Attendees also heard a special presentation from Liz Podowski King of Bergmann Associates who described how the funding cycle works for Downtown Revitalization Initiative (DRI) projects and how lending institutions can participate.

We are looking forward to hosting more CEDA 101s where we can educate other business service providers about our economic development incentives and programs. If your agency or organization has a question about programs or services that support business growth in Cayuga County, please contact us.